27 April 2021

In 2018, Bank Mandiri and ElysianNxt embarked on a project which started with the Expected Credit Loss (ECL) requirements under the IFRS 9 (PSAK71) framework. With limited time to implement the project and pressing external pressures, the project markedly needed to be implemented quickly and efficiently. A faultless implementation process was achieved due to an open and transparent partnership in which the users quickly realized the power of the ElysianNxt platform in terms of overall user friendliness as well as the benefits of using the latest proven technologies in their credit risk operational processes, something they had not been able to achieve historically.

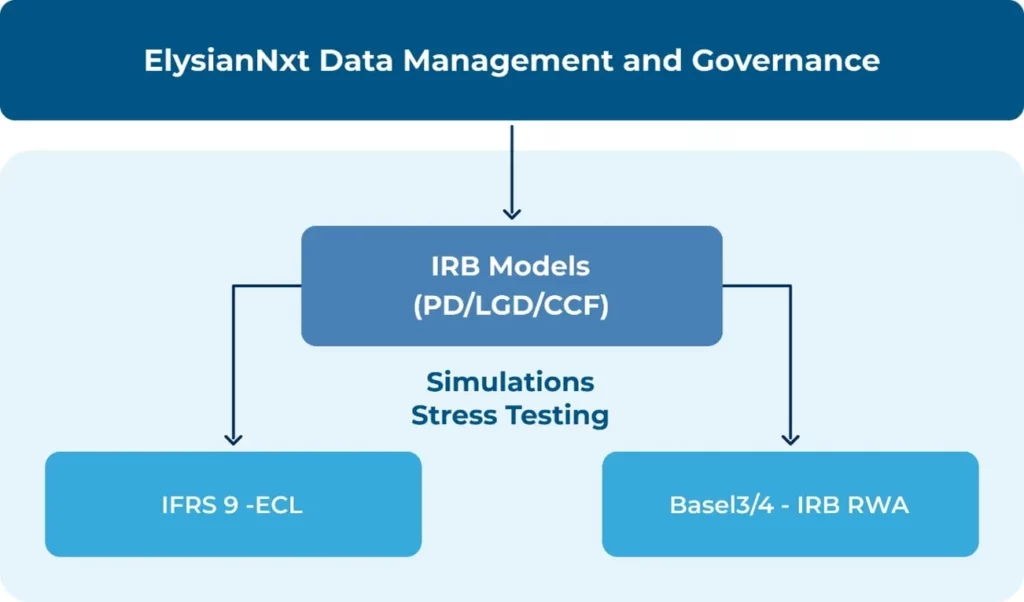

The consummate and complete success of the IFRS 9 project has triggered the Bank to include the ElysianNxt platform as part of the overall IT transformation program of the Bank. As one of the very first adopters of ElysianNxt’s game-changing solution, the Bank astutely recognized the platform’s ability to allow them to consider ‘what is possible’ rather than ‘what is sufficient’. This lead to an initiation of the second phase of the overall project, where the Bank’s Internal Credit Risk Models could be hosted on the ElysianNxt platform. With unprecedented processing times and transparency, the Credit Risk users now have full confidence in explaining the models and their outputs in a business-as-usual setting for simulations and stress testing purposes.

Rather than follow a common trend within the financial services industry of investing into internal models that are purely focused on the outcomes, i.e. the risk factors, and not on useability or even performance, the Bank decided to host their internal Probability of Default (PD), Loss Given Default (LGD) and Exposure at Default (CCF) models on the ElysianNxt platform. In an increasingly volatile business environment, modelling demands will only increase and traditional barriers to ad-hoc and intra-day simulations of the entire credit risk measurement chain will need to be removed.

The Bank’s foresight to opt for a lesser known, yet more agile, dynamic solution in the market place, coupled with ElysianNxt’s flawless execution, proved successful as it enabled the Bank to enter into the next stage of the process in an unprecedented manner. This new partnership would now allow the implementation of the Credit Risk Capital Requirement calculations under the Basel framework, currently under the Standardized Approach. The Bank is delighted with the outcome of this phase in the overall project, ensuring full compliance with the current Basel III rules under OJK, including RWA, Leverage Ratio, CVA and SA-CCR. This initiative will also provide full readiness for the upcoming Basel IV revisions making sure that the Bank is not only ready for all its regulatory obligations but also any unexpected ‘what if’ scenarios that may occur during these unpredictable times. This meant, building further on the same underlying data sets that are used for the calculation of the ECL allowed the Bank to move at an unparalleled pace, obtaining Basel III and Basel IV compliance with ElysianNxt in three and two months time respectively.

The final stage of the project will bring everything together with the implementation of the Advanced Internal Ratings Based Approach (IRBA). The successful implementation of the internal models (PD, LGD and CCF) onto the ElysianNxt platform, along with the Basel Regulatory Capital framework in place for the Standardized Approach, concludes the full automation of the completed regulatory credit risk framework as depicted below:

This successful partnership and ongoing commitment to the project will place the Bank in a uniquely enlightened position relative to its peers, both locally and globally. The Credit Risk users will have the enviable and beneficial ability to run any ad-hoc simulation in an integrated way and in-the-moment. The ability to simulate changes to any internal risk model, assessing the impact of this change on the Bank’s provisions and capital in a matter of minutes is nothing short of groundbreaking.

“ElysianNxt has been THE core element in our project for Expected Credit Loss (ECL) calculation under the IFRS 9 (PSAK 71) framework since 2018. The inimitable professional approach, understanding of our needs and flexibility of the platform led to building an IFRS 9 system that precisely match our requirements and is market leading in its effectiveness and execution. We cannot think of another solution that could have provided us with a faster processing time, simpler usability of interface and overall support. In hindsight, we are glad for having the courage to select a new, nimble company like ElysianNxt which has ultimately proved immensely rewarding and valuable for us. We thank the whole ElysianNxt team for their dedication and hard work and we look forward to enjoying a long and mutually beneficial partnership.”

Alfanendya Safudi, FRM, CFA – Senior Vice President PT Bank Mandiri (Persero) Tbk.

“Mandiri’s leadership team had the courage and the vision to choose a platform based on next generation technology from a new vendor in the market. It has been an honor and a privilege to work very close together with Bank Mandiri to realise the amazing potential that streaming technology has for the Risk Management function of a big bank. We are very grateful for this unique chance that Bank Mandiri has given to us.”

Chris Puype, CEO and Founder ElysianNxt.