ALM strategies combine risk management and financial planning to address long-term risks that can emerge due to changing circumstances. This practice encompasses strategic asset allocation, risk mitigation, and adjustments to regulatory and capital frameworks. By effectively matching assets against liabilities, financial institutions can maximize investment returns and increase profitability within their accepted risk appetite frameworks

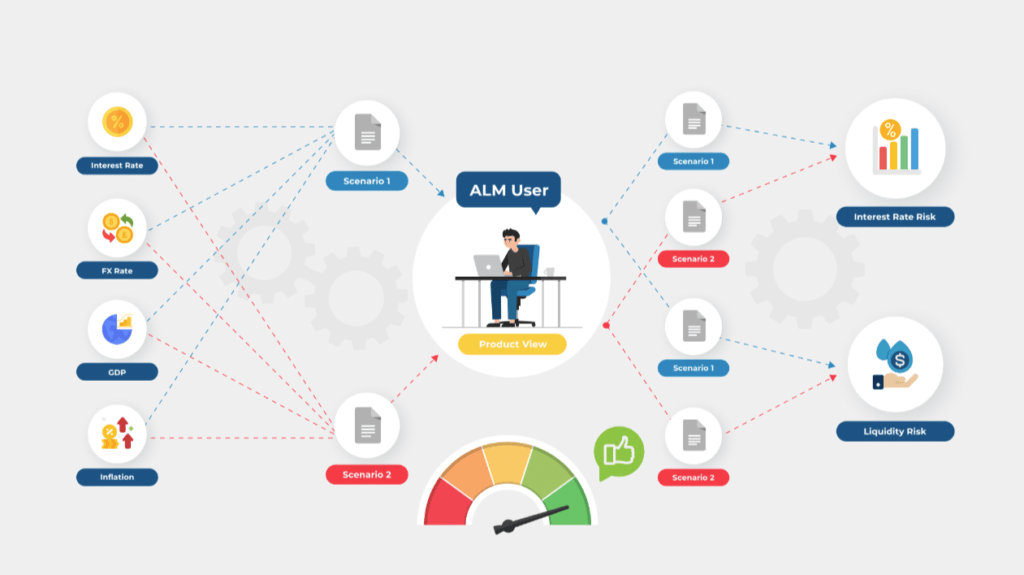

Assisted by traditional solutions, ALM practices have long focused on product decisions, such as rollovers, growth assumptions, new product launches, etc… to reach optimal risk/return outcomes. These models have been instrumental in short-term earnings forecasting and liquidity planning under various business strategies. Recently, the business environment has become significantly more volatile, rendering traditional ALM solutions and practices less effective than before business strategy modelling focus has shifted from BAU to disruptive scenarios, requiring a fundamental change in modelling capabilities.

Why is ALM Especially Challenging Today?

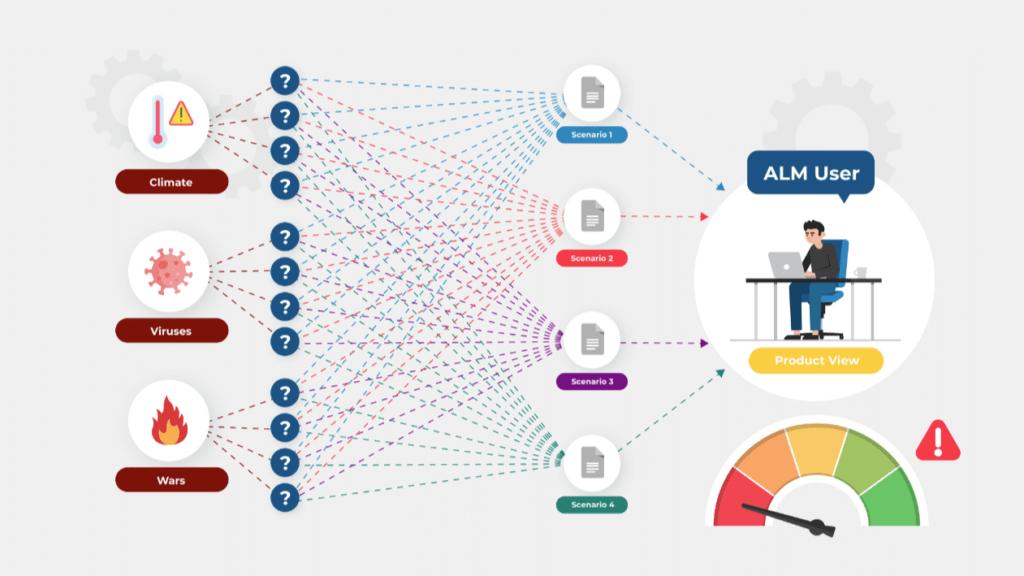

Economic crises, wars, pandemics, and climate change have all significantly disrupted the financial landscape. Multiple risk parameters are now prevalent, resulting in more complex scenarios. This new reality means financial institutions can no longer base business decisions solely on their Chart of Accounts (CoA) or within short timeframes. The challenges now include:

- New scenarios being introduced into the equation. This includes climate change, which affects the productivity of various industries, such as agriculture. Changing global trends is also a significant consideration, such as the shift to clean energy, affecting the outlook of fossil fuels and renewable sources. Financial institutions must therefore be ready to adapt their business strategies to respond to multi-layered scenarios with increased complexity.

- Time horizons now extend beyond the traditional 1, 3, and 5 years. Certain scenarios have a predicted long-term impact. Scenarios stated in the previous point may take decades for their consequences to unravel. Therefore, financial institutions must now take an extended outlook on the economic conditions.

- Credit risk is now a central consideration, rather than an afterthought. Due to the increased variability observed in each unique market, the risk variance of each borrower has increased. The evaluation of credit risk for each entity is now of greater importance in ensuring profitability and stability.

Given these challenges, banks need more advanced tools that can help them assess long-term business strategies under multiple unpredictable scenarios. Traditional solutions may no longer be ideal for assessing unchartered territory. To address this urgent concern, advanced modeling capabilities are now provided by modern ALM solutions.

Why Traditional ALM Solutions Don’t Work Anymore

Traditional solutions have several limitations:

- Typically built on outdated, often decades old, environmental assumptions. Predictions based on outdated assumptions can yield inaccurate information that is possibly no longer relevant.

- Limited modeling capabilities, heavily focused on product decisions. Risks are traditionally assessed from a product-centric perspective. However, with current market fluctuations, more importance must be given to external factors, which can have a large impact on decisions and outcomes.

- Short-term evaluation focus, typically limited to 1, 3, or 5 years. With changing conditions nowadays predicted to have impact lasting over 5 years, longer term evaluation is now a critical outlook to adopt.

- Inadequate capabilities to include credit risk in the analysis. As credit risk was an afterthought in previous practices, traditional solutions may underweight this significant risk parameter

Most ALM solutions originated 2 decades ago and are designed to model and measure incremental changes to the business environment and business strategies. They are less well suited as a navigation tool for strategic decision making in a disruptive environment.

ALM.NXT: Bridging the Gaps in Traditional ALM

ALM.NXT is at the forefront of modern ALM solutions, addressing the critical gaps left by traditional models while providing a structured, fast, and user-friendly experience. Here’s how:

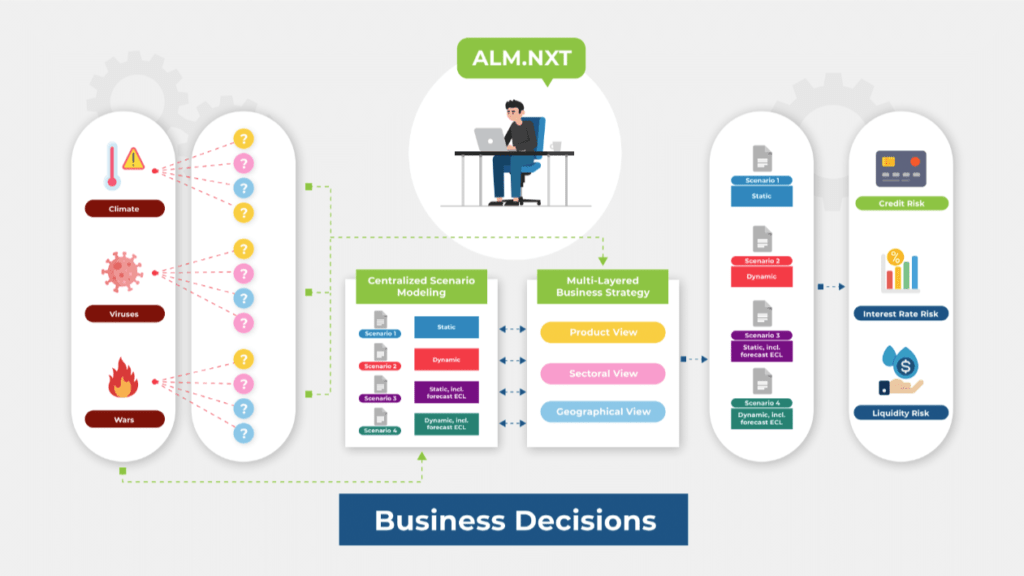

1. Centralized Scenario Model

ALM.NXT provides a centralized scenario model where scenarios are defined in a structured manner, and macroeconomic forecasts are attached to these scenarios. This structure ensures consistency and accuracy in scenario analysis.

2. Multi-Layered Business Strategy Modelling

Within each of the Macro-economic scenarios, multi-layered business strategies can be modelled. ALM.NXT allows banks to flexibly define multiple segmentation through the user interface, including by product, sector, geography, and more. It also enables the configuration of dynamic behaviors to simulate countless business scenarios, enabling the optimal formulation of business strategies.

3. Comprehensive Risk Integration

With full integration across all risk types, including credit-adjusted ALM, ALM.NXT ensures that financial institutions can assess the interconnected risks that impact their balance sheets. This comprehensive approach provides a more holistic view of potential risks and their implications.

4. Fast Processing with Streaming Technology

Using advanced streaming technology, ALM.NXT can reduce hours of processing into minutes. This key capability allows institutions to quickly adapt to new information and rapidly changing market conditions, maintaining a competitive edge.

5. Regulatory Compliance

ALM.NXT also includes pre-configured regulatory scenarios for ALM reporting, including Interest Rate Risk in the Banking Book (IRRBB), Credit Spread Risk in the Banking Book (CSRBB), and liquidity reporting. This feature ensures automatic compliance with evolving regulations, reducing the burden on institutions to manually update their models.

Upgrade Your Strategy with ALM.NXT

Recent disruptions in the financial landscape signal the urgent need for changes in ALM approaches. Financial institutions must now adopt increased adaptability to changing scenarios and plan for a longer-term outlook, assisted by modern ALM tools that consider all risk interdependencies to evaluate long-term business strategies effectively.

ALM.NXT provides the advanced capabilities needed to navigate today’s complex financial environment, to ensure your institution’s success. For more information, view Revolutionizing Balance Sheet Management: ALM.NXT’s Advanced Scenario Analysis or contact us here.