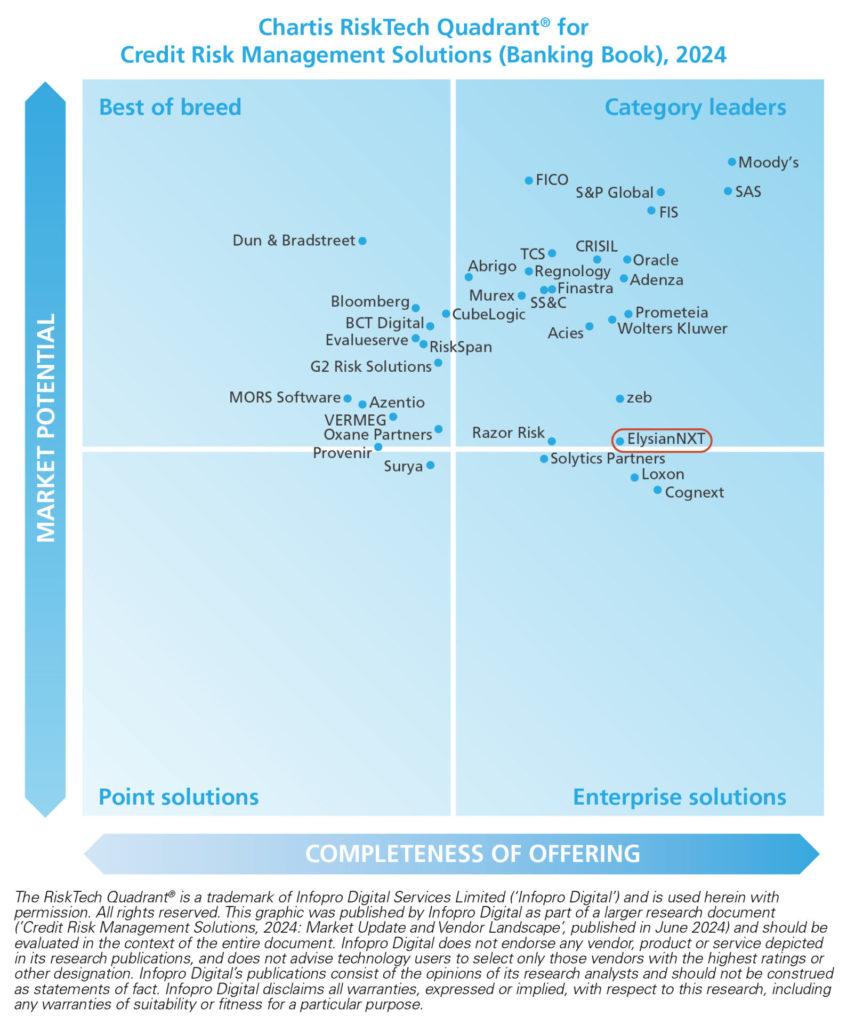

June 10, 2024- ElysianNxt is recognized by Chartis as a Category Leader in Credit Risk Management Solutions (Banking Book) in their RiskTech Quadrant 2024.

What is Chartis RiskTech Quadrant?

Chartis RiskTech Quadrant 2024 examines a number of players providing risk solutions in the market under key criteria including Market Potential and Completeness of Offering – Market Potential considering market penetration, financials, etc. and Completeness of Offering including the depth and extensiveness of overall services.

Why is Credit Risk Management Solution in the Banking Book a significant category?

“Complying with credit risk regulations can be a challenge for many financial institutions, and data management is central to the compliance process. ElysianNXT’s category leader position in our quadrant reflects its steadily evolving banking book platform, which focuses on building a fully integrated credit risk infrastructure to enable firms to manage data and perform a variety ofcredit risk calculations and associated analytics.“

– Anish Shah, Researcher Director at Chartis

The Chartis RiskTech Quadrant 2024

This recognition reinforces ElysianNxt’s position as a strong Risk Management solution provider and a sustainable player in the market amongst other big names.

If you would like to know more about our Credit Risk Management in the Banking Book or other risk solutions including IFRS 9, Basel IV, ALM, Stress Testing, please contact us here.